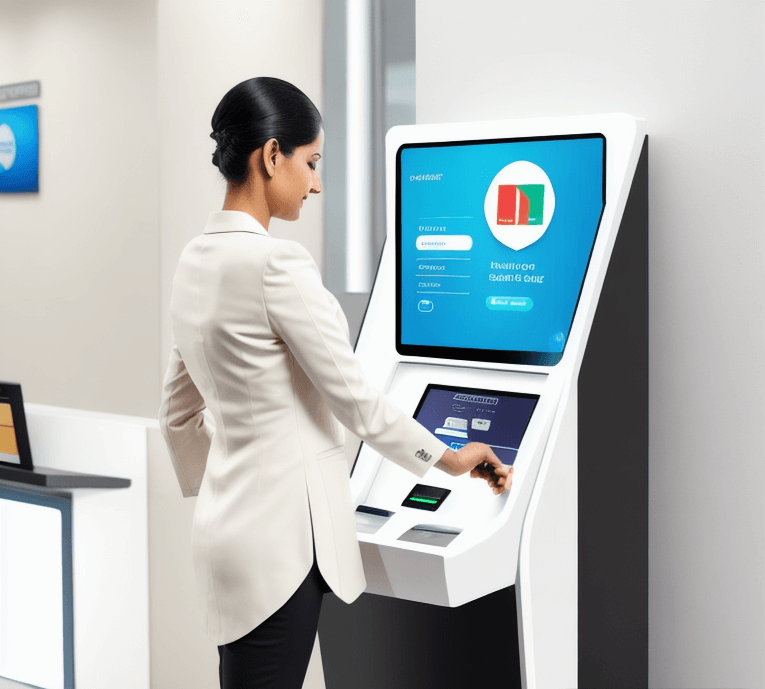

Our Banking & Finance Kiosk

Origin of the utility of the self-service technology can be most related to the ATM services provided by the banks to the customers to be able to access their accounts without queuing up for a teller. Major role of the ATM was to provide Cash transaction facility 24*7 to the account holders without having to go to the branch from any part of the world.

However, in the recent years, this self-service technology has advanced tremendously to provide a number of other non-cash and non transactional facilities to the said account holders at the bank branches as well as non-bank branches to increase customer satisfaction and retention.

Also, with the aim to maximize financial inclusion in India, providing the banking services in the semi-urban and rural areas is also a top-priority of the Govt. With the unavailability of bank branches in each and every location, these Kiosks can be deployed at various public places to provide the basic banking services needed by any account holder.

In a busy environment where customers often have just minutes to complete important transactions, kiosks can provide efficient customer service while freeing up customer service advisors to deal with those who need further attention. In this way customer service is improved throughout the branch, for all customers, at a greatly reduced cost.